As mentioned in my previous post (Singapore Credit Cards – Citi Prestige vs Citi Premier Miles) my Singapore credit card of choice was the Citi Prestige card. DBS have recently launched their new “DBS Vantage” card which caught my eye. I’ve now made the switch and I wanted to share with you why!

Sign Up Bonus Update: DBS has extended the 60,000 bonus miles sign-up offer to 30th June 2023. To trigger the reward, you have to spend S$4,000 within 30 days and pay the S$594 annual fee. Sign up here.

Citi Prestige vs DBS Vantage

The DBS Vantage Card is a Visa card issued in Singapore. It’s aimed at the mass affluent sector of the market and aims to attract those earning over S$120,000 a year, but less than the S$500,000 required for the DBS Insignia card. It has an eye-catching metal design which feels heavy and luxurious.

Before I explain my choice to move over to the DBS Vantage card, let’s take a closer look at the main features of each card. What I value the most may not be the same as you, so make sure to take a good look through the feature list and make sure they align with your lifestyle. There’s no point paying a fee for a card with lots of bonus rewards if you don’t take full advantage of them!

DBS Vantage

A detailed list of features is available here.

| Annual Fee | S$594, this fee can be waived after the first year if you make S$60,000 of retail spend during the prior year | |

| Points | S$1 = 1.5 miles / 1.5% cash back for local spend S$1 = 2.2 miles / 2.2% for foreign spend S$1 = 6 miles for spend on the DBS Expedia travel portal You can also switch to cash back instead of miles if you prefer | |

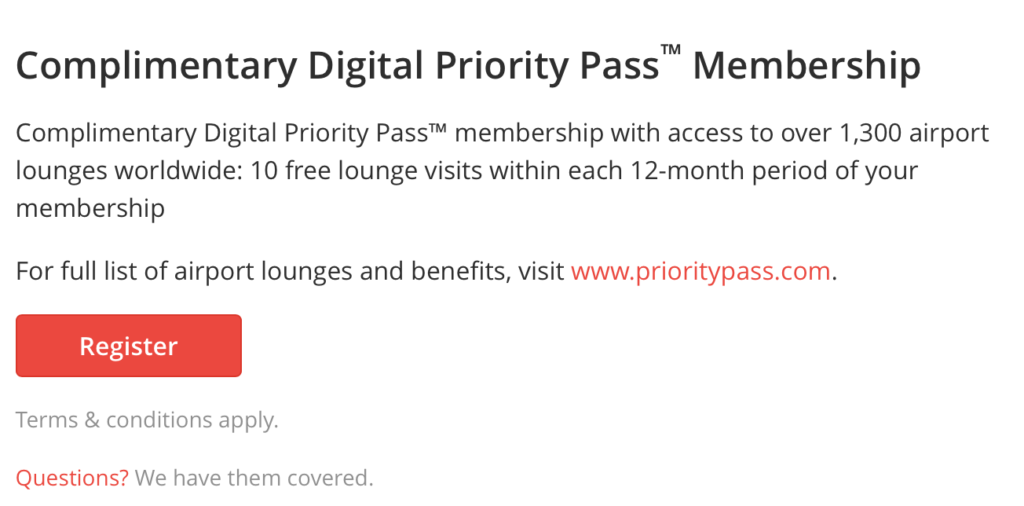

| Airline Lounges | 10 visits to Priority Pass lounges per year | |

| Hotel Privileges | Accor Plus Explorer membership is included with 50% of meals at Accor hotel restaurants and one free night stay | |

| Dining | Up to 50% off meals at fancy restaurants in Singapore through a dedicated gastronomic booking portal | |

| Other Benefits | Access the Visa Concierge service 24/7 with a curated range of services, amenities and exclusive privileges | |

| Sign-up Offers | 60,000 bonus miles sign-up offer to 30th June 2023. To trigger the reward, you have to spend S$4,000 within 30 days and pay the S$594 annual fee. 25,000 bonus miles on renewal subject to paying the annual fee. |

Citi Prestige

A detailed list of features is available here.

| Annual Fee | S$540, no fee waiver | ||

| Points | S$1 = 5 ThankYou Points (2 Citi Miles) for on foreign currency spend S$1 = 3.25 ThankYou Points (1.3 Citi Miles) for local spend | ||

| Airline Lounges | Unlimited access to Priority Pass lounges for you and a guest | ||

| Hotel Privileges | Complimentary night stay when you book a minimum consecutive four-night stay at any hotel or resort. This doesn’t apply to suites. See section below on how this benefit is now greatly diminished! | ||

| Dining | 1 for 1 on high end dining – this is a really nice feature but the top restaurants sell out quickly! | ||

| Other Benefits | Six complimentary golf games at highly celebrated golf courses in Singapore, Malaysia, Indonesia and China Get up to 30% additional ThankYou Points for your relationship with Citibank From travel and entertainment to day-to-day tasks such as organising a delivery, the global Citi Prestige Concierge can help | ||

| Sign-up Offers | From now until 30th June 2023, get a 48,000 miles sign-up bonus with a new Citi Prestige card and only S$800 spend. 25,000 bonus miles on renewal subject to paying the annual fee. |

As you can see, each card offers a lot of perks. This is especially true for the Citi Prestige Card, which is why it has always been my card of choice in Singapore. So why have I switched to DBS Vantage…?

What’s my beef? Why the Switch to the DBS Vantage Card?

I’m now using the DBS Vantage card as my main credit card in Singapore along with my Trust credit card (which I use solely for groceries rewards – more on this in my next post). My credit card strategy is to charge as much of my day-to-day expenses to the card as possible, pay off the balance in full every month (no exceptions) and make use of as many of the card benefits as possible.

Travel Perks

One of the main things I used the Citi Prestige card for was the travel perks. The two best Prestige card features for travel are 1) the unlimited Priority Pass lounge access; and 2) the four hotel nights for the price of three reward.

Of these two features, the first still stands and hands down beats the measly 10 visits offered by the DBS Vantage card. However the hotel benefit is now next to worthless. Previously you booked via the Citi Prestige concierge team who were always polite and chatty. Crucially the team used to use Expedia for the bookings so you could easily research all of your options before calling and ensure you pick the best hotel for your money prior to calling. This whole experience has changed, significantly for the worse!

Citi Portal instead of Expedia

Instead of using Expedia, Citi now have an in house portal which is more expensive than Expedia. On all of the recent occasions I’ve tried to make a booking via the concierge, the price was so much higher than Expedia that it cancelled out the value of the free night.

General Customer Service

The concierge team also seems to have changed – no longer are you greeted with happy, chatty people who are eager to help. This includes no or very late email follow ups and endless wait times whilst they check the internal booking portal.

This leads to a bigger gripe too, the Citi Prestige card is marketed as an mass affluent “status” card with impeccable service. Instead, the recent customer experience seems to have fallen off a cliff. The overall customer experience coupled with the hotel reward being unusable has pushed me to switch to the DBS Vantage card. Especially with the 60,000 miles sign up offer.

The DBS Vantage Expedia Portal

I wanted to highlight one of the benefits I’ve used the most. This is the DBS Expedia Travel Portal – the link to which is hidden deep in the rewards pages on the sprawling DBS website. This portal allows you to turbocharge your miles and earn up to 6 miles per S$1 spent on travel. I’ve noticed that the portal can sometimes be a little more expensive the the normal Expedia site, so make sure you check both to see if the extra DBS miles are worth it.

The DBS Vantage Downsides

It’s not all unicorns and rainbows with the DBS Vantage card. I’ve got four big gripes:

Card Management

Card management is via DBS iBanking. The usability of the credit card “zone” is pretty unintuitive. It’s hard to work out how much you’ve spent in the current month without a quick mental calculation deducting your available balance from your credit limit. Only the “outstanding amount” is clearly visible from your previous statement. This shows as zero if you clear it until your next statement comes through. This whole area of the app needs a refresh.

Priority Pass Privileges

The priority pass lounge access is limited to only 10 visits. If you bring a friend on each visit then that’s only five flights per year. If you are a frequent traveller and don’t have access to miles via your airline status, this won’t likely last a full year. Given the general quality of the Priority Pass lounges, you won’t miss much, however it is still nice to have a quiet place to relax pre-flight.

DBS Reward Portal

To utilise your DBS miles and cash them in you have to use the DBS Rewards portal which looks like it hasn’t been updated since 2003. This is not a big deal, but is screaming for a revamp! Fees are charged for each points exchange, so it’s better to do it in bulk.

DBS Reward Point Expiry

Unlike with CitiPrestige, the DBS Reward Points expire after three years so you need to transfer to your points programme within that time. I still think this is ample time to make use of your points.

Done and dusted

So there you have it. I’ve moved to the DBS Vantage card and so have a lot of my friends. It’s not perfect, especially on the UX side of the app and website, but the travel features are solid and tick all my boxes for my main credit card. Let me know in the comments if you make the switch too!

LY

10/06/2023 9:51 amYou might want to include a comparison of the bonus frequent flyer miles you get on sign up and each renewal. For both, they are 25,000 miles and potentially more at signup, depending on promotions and T&Cs.

Money Mountain Goat

16/06/2023 9:37 amGreat idea, thank you! I’ve updated the table with the current offers. Look out for what happens after 30th June when the current sign-up offers expire.