The goal of Financial Independence (FI) is to live off the income generated by your assets. The core tenets of FI are living frugally and increasing your savings rate to 60%+. But what are you supposed to do with this new (and growing) stockpile of cash? The answer, is low cost index fund investing!

Index fund investing is the cornerstone of the FI movement and warrants a detailed look at what, why and how?

What is an index fund?

An index fund is a type of mutual fund or exchange traded fund. It is passively managed and seeks only to mirror the performance of the underlying index. As you don’t pay for a fund manager to actively pick stocks, the fees you pay are typically very low.

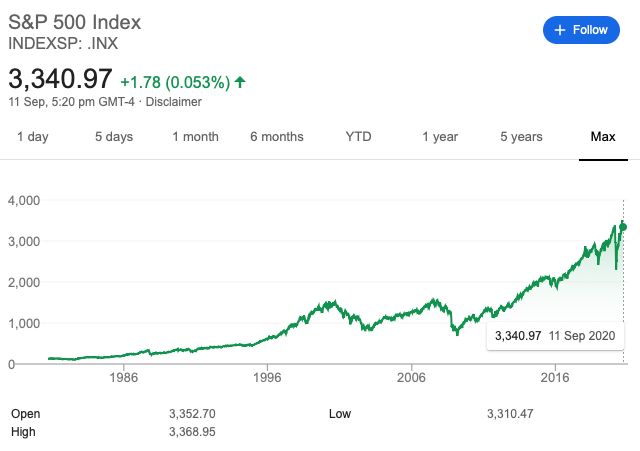

Over the long term, index funds tend to out-perform actively managed funds. One of the most popular index to use for investing in the FI community is the S&P 500. The trend of the S&P 500 is ever upwards (with some blips on the way). Over the long term, its rise is continuous and impressive (though of course this is not guaranteed for the future).

Why invest in an index fund and not mutual funds or individual stocks?

Picking individual stocks is a fools game. It is of course possible to make a fantastic return on a good pick, but this is really just gambling. For the long term investor seeking to reach FI, stock picking is not for you.

Two key issues with picking individual stocks:

Timing the market

As we don’t have a crystal ball (that actually works), we don’t know whether a stock will rise or fall. Whether that company will even still be around in 5 years time, not to mention in 10 years time. When investing in individual stocks, you have to time the market on acquisition AND on sale. You need to have two crystal balls! This makes it near impossible to time it right, meaning you will probably buy too high and sell too low. Disastrous.

Brokerage fees

You will also be charged fees to buy and sell individual stocks. If you are gaming the market, fees alone will wipe out the gains you may (or probably won’t) achieve.

Index fund fees

Because index funds are passively managed, the annual fees charged are minuscule. Some actively managed funds charge up to 5% per year based on the value of your holding. You pay this regardless of whether you make money or not! Index funds can be as low as 0.04%.

If an expense ratio is 0.04%, for every $100,000 of shares in the index fund you hold, you will pay $40 to the management company. If the expense ratio is 3%, you will pay a whopping $3,000!

Fees really matter when you are investing for the long term

Over the long term, high fees destroy value and your wealth, whereas the low fee environment of index fund investing builds your wealth. The money saved on fees is compounded and will grow exponentially over time along with your capital invested.

Buying your freedom

Once your investment accounts reach your FI number, you can then safely withdraw 4% per year (though do your research on what is right for you) to cover your living costs forever.

Withdrawing a safe amount protects your capital and allows it to increase over time with inflation. It sounds like magic, but it’s really just basic math.

Popular index fund choices

There are a tonne of such funds to choose from but the most popular include those funds which mirror the performance of either the entire USA stock market (a total index fund) or the S&P 500. The companies which make up these indices are global diversified multinationals. By buying a share of an index fund, you are buying a small slice of ALL of the companies which make up the index.

So which funds are popular?

- Vanguard Total Stock Market (VTSAX)

- Vanguard Total Stock Market Index Exchange Traded Fund (VTI)

- Vanguard 500 Index Fund (VFIAX)

- Vanguard Mid Cap Index Fund (VIMAX)

- Vanguard Real Estate Index Fund (VGSLX)

Things are pretty easy if you live in the USA, do your research on the funds above (and other index funds out there) and choose which one is right for you.

If you don’t live in the USA, you may not have access to Vanguard’s funds and ETFs so you’ll need to find a local workaround. The key things to look for are the expense ratio (see above) and what the index is and whether it suits your risk appetite. Always remember that even index investing entails risk, you might lose money but hopefully in the long run you will make a lot of money.

For those of you based in Singapore (like me!) Fire Path Lion has a really neat post which gives some direction and local Singapore flavour on what funds are available.

If you want to follow along with my FIRE journey and never miss out on any post, please subscribe to the MMG newsletter:

Jordan @ FIRE Your Own Way

26/09/2020 1:33 pmTotally agree on avoiding individual stocks for most investors. And also on the challenge (the almost impossible challenge perhaps I should say) of timing the market!

Just wondering about the core tenet of FI you mentioned as being a savings rate to 60%+. Any reasons for setting the minimum at 60%? (Don’t disagree with it – just curious as to where the number came from 🙂 )

Money Mountain Goat

27/09/2020 11:53 amAgreed! Market timing is basically impossible, even in banks etc. People have made some big wins on individual stocks but for the slow and steady FIRE path they are best avoided. On the 60%+ savings rule, firstly saving anything is a big WIN! Getting to the position where you are regularly saving and increasing your wealth is fantastic and needs to be celebrated. The 60%+ figure though is really there to meet the ‘Retire Early’ part of FIRE, to get there early you need to supercharge your savings rate to slash the number of years needed to get to your FI number. When you start saving 60% you are looking at an RE time horizon of 12.5 more years, at 70% this is 8.5 years and 80% its 5.5 years from a zero starting position. The math behind this (which is really well explained on the MMM Blog is hugely affected by the amount you are spending of your income each month (the lower the figure, the smaller your FI number will be). I’m aiming for a 70%+ rate and having a little nest egg already should reach traditional FI in 5 years time when I turn 40 (all things being well!).

Jordan @ FIRE Your Own Way

28/09/2020 8:35 am5 years is a great aim! I want to retire by 40 too so sounds like we’re on the same page there 🙂

Good point about time to retirement. Any savings rate over 65% is certainly a benchmark in terms of enabling retirement within 10 years. I’d love to hit a 70%+ saving rate every month.