When personal finance meets tech, all sorts of exciting things can happen. The idea of becoming rich overnight due to the actions of some clever algorithms working away you sleep is very appealing. We maybe edging closer to such a reality, but we are not there yet! We are however now in the age of the Robo Advisor. In this guide we take a look at the available Singapore Robo Advisors and look at them in the context of FIRE (focusing especially on the management fees charged).

Table of Contents

This is a longer post than normal, feel free to jump the section of most interest to you:

- What is Robo Advisor?

- What are the main Robo Advisor Platforms in Singapore?

- A thorn in your side – the LARGE annual fees for Singapore Robo Advisors

- Are Singapore Robo Advisors suitable for people on the path to FIRE?

Ok, let’s dive in….

If you want to follow along with my FIRE journey and never miss out on any post, please subscribe to the MMG newsletter:

What is a Robo Advisor?

Robo-advisors are digital platforms driven by algorithms that provide automated financial planning services with little or no human supervision. A typical robo-advisor collects information from clients through an online survey, and then uses the data to offer advice and/or automatically invest client assets.

The best Robo Advisors come with a great mobile app, great tracking and financial planning feature (including goal setting), are simple to use, have a quick sign up process, low minimum investment amounts and are particularly appealing to tech-savvy millennials.

What are the main Robo Advisor Platforms in Singapore?

The Singapore Robo Advisor platform space is currently burgeoning. This is great for us consumers as it will hopefully mean we get a better services, apps and crucially, lower annual fees. Currently the Singapore Robo Advisors can be split into two categories; challenger FinTech platforms (and classic investment platform add-ons) and platforms from traditional banks.

Challenger Platforms

StashAway [Updated 24/04/21]

StashAway is a really neat platform. Its intuitive, user friendly and they claim you can be set up in as little as 15 minutes. Before I stumbled upon the DBS DigiPortfolio I opened an account with StashAway. I therefore have more detailed information on this platform than the others.

When using the StashAway iOS app and when ready to invest, you are taken through a step by step process by which you ‘build your plan’.

To do this you are required to select your source of funds (current account or Supplementary Retirement Scheme (SRS) account) and then choose: (a) general investing; (b) goal-based investing; or (b) earn income and returns. From there, you are asked to set a risk category (e.g. core which are more balanced and lower risk, or higher risk which seek to obtain higher returns) to then show you your relevant portfolio. You then have a final choice to set your ‘StashAway Risk Index’. This then impacts the portfolio asset allocation (e.g. % of equities vs bonds):

Finally you can opt-in or out of auto portfolio re-optimisation which, if selected, will allow StashAway to adjust your portfolio over time to ensure it stays balanced in accordance with your asset distribution choices. This is cool because it can be a pain to do manually!

What are the Fees?

StashAway fees are on the higher end but are still in the standard range for a Singapore Robo Advisor. Fees drop significantly with the more you invest. Though note, these fees are only the StashAway fees, additional fees (around 0.20%+) will be paid to the underlying ETF manager!

High Interest Savings Account Alternative

StashAway Simple (SAS) is an alternative to a traditional high interest savings account. SAS is a lower risk investment account with no lock in, minimum balance or withdrawal restrictions. Currently the estimated rate of return is 1.4% per annum (though note that this is not guaranteed). Funds in SAS are invested in two funds:

- 50% of your assets to the LionGlobal SGD Money Market Fund; and

- 50% to LionGlobal SGD Enhanced Liquidity Fund SGD Class I Acc.

It’s possible to invest in these funds directly through your brokerage account but StashAway say that the advantages of investing using SAS are two fold:

First, with the enhanced liquidity fund, we are using an institutional share class that has lower total expense ratio (annual fee charged by the ELF’s fund manager) than the retail share class available on FSM or anywhere else. So, we give you access to the ELF at a lower cost. Second, we return all rebates from the enhanced liquidity fund and money market fund back to you. Most other platforms and fund managers don’t do this.

https://www.stashaway.sg/simple

The point of an SAS account is to ‘manage your cash’. This sort of product could be a good alternative for stashing your emergency fund. That way it would earn more than if it was in a typical current account.

MMG Verdict?

StashAway is a great option for those new to investing and are looking for a place to start. The fees are on the higher end, especially when you include the additional fees to the ETF managers but StashAway does pass through any rebates etc. The platform is user friendly and makes investing fun. Over the medium-long term however the higher fees will really eat into your nest egg.

Endowus [Updated: 24/04/21]

Endowus comes with a really user friendly app with an easy sign up process and risk profile analyser. The platform will model growth depending on your risk profile and the funds which it recommends for you.

You are able to invest cash, CPF and your SRS money with Endowus which is pretty handy. Endowus set out a number of ‘Model Portfolios’ the makeup of which depend on your risk appetite through 6 tiers of risk from Very Aggressive down to Very Conservative. The bond/equity ratio tracks from 100% equities to 100% bonds through the risk profiles.

Three additional nifty features of Endowus are:

- Automatic rebalancing: this ensures your portfolio tracks your goals, so that it stays in balance over time.

- Lifecycle information: generally speaking, as you age and approach traditional retirement age, typically people move asset distribution away from equities and into bonds. Endowus help notify you when you should do this and provide information about why.

- Automatic Investments: It is possible to set up automatic monthly investments which is a great way to ensure you stay on track with your investment goals over time.

All of the Endowus funds are denominated in Singapore dollars which removes currency exposure risk.

What are the fees?

The headline rate for Endowus is 0.60% (excluding the CashSmart account – see below). The fees decrease with the more you invest as follows:

- 0.60% – S$200,000 and below

- 0.50% – S$200,001 to S$1,000,000

- 0.35% – S$1,000,001 to S$5,000,000

- 0.25% – S$5,000,001 and above

When investing your SRS or CPF funds, the fee is a flat 0.40%. Remember that the underlying funds/ETFs will also charge a fee. The above is only the Endowus cut. I have personally invested my SRS funds with Endowus in the Fund Smart portfolio (which allows you to create your own portfolio from a limited set of funds). I’ve gone with the following ratio:

- 25% – Dimensional Emerging Markets Large Cap Core Equity Fund;

- 50% – LionGlobal Infinity US 500 Stock Index Fund; and

- 25% – PineBridge India Equity Fund.

High interest savings account alternative?

CashSmart is the high interest savings account alterantive offered by Endowus. It promises a rate of return of up to 2% which is higher than the current rate (October 2020) offered by StashAway. You can fund your CashSmart account from cash or your Singapore SRS which is an added bonus.

There are two types of CashSmart account available:

- CashSmart Core: this is for cash you need in the upcoming days or weeks, Endowus claim that it is unlikely to ever have a day of negative performance with its worst historical drawdown from peak to trough was only 0.02%. The trade off is that the target rate of return is only 1.2% per annum. The two funds which are invested in for CashSmart Core are:

- 50% Fullerton SGD Cash Fund – Class A (ISIN: SG9999005961); and

- 50% Lion Global SGD Enhanced Liquidity Fund

- CashSmart Enhanced: this has been designed as a place to store cash you made need in the coming months (perhaps emergency fund territory!). It has more volatility than CashSmart Core with its worst performance being a 1% drop in value. This additional risk level correlates to a higher rate of target return of up to 1.9% per annum. The two funds which are invested in for CashSmart Enhanced are:

- 50% Lion Global SGD Enhanced Liquidity Fund (ISIN: SG9999019301); and

- 50% UOB AM United SGD Fund (ISIN: SG9999001382)

- [Updated 24/04/21] CashSmart Ultra: Endowus has recently upped the ante and published a new ‘ultra’ product which seeks to provide enhanced returns of up to 2.4% per annum. The basket of funds which are invested in are more wide ranging as follows:

- 27.5% LionGlobal SGD Enhanced Liquidity Fund

- 25% Fullerton Short Term Interest Rate Fund

- 25% LionGlobal Short Duration Fund

- 12.5% Nikko Shenton Income Fund

- 10% PIMCO Low Duration Income Fund

Endowus charges an Access Fee of 0.05% per year for the CashSmart accounts. Endowus has institutional access to these funds meaning its likely a cheaper way of investing into the funds above than going direct through a brokerage (though many other options would be available by going direct).

It’s important to note, as with the other high interest savings account alternatives, that these are still investments (albeit lower risk). You can therefore lose money like with any other investment.

MMG Verdict

The Endowus fee level is pretty competitive vs the other Singapore Robo Advisors, but the high minimum deposit may make it difficult for newbie investors to utilise the platform. The CashSmart high interest savings account is another good feature and it has the added benefit over StashAway of two risk profiles options. The Access Charge of 0.05% along with very low yields makes it less appealing.

I’m now using Endowus for my SRS contributions. I’ve built my own portfolio with 50% S&P index, 25% India focus index and 25% emerging markets index. The fees to do this are higher than using my Saxo brokerage account, but as SRS funds can only be used in certain ways. Using Endowus to invest SRS money is a good option for me.

You can get 6 month’s free Access Charge if you sign up using the MMG referral code by clicking here.

AutoWealth

AutoWealth feels less like an anonymous tech giant platform and more like a serious brokerage. It has a few unique features, such as providing customers with a dedicated wealth manager (contactable using WhatsApp), custodial accounts in your own name (reducing risks in an insolvency situation of AutoWealth but with the added headache of holding another account with another provider – Saxo) and a unique fee structure. Though its set-up process and user interface is not as good as it should be given this is a ‘digital first’ platform.

AutoWealth state that:

All AutoWealth investment portfolios feature a portfolio mix of Equity (Stocks) and Fixed Income (Govt Bonds), diversified across major geographical regions in the world including U.S., Europe and Asia Pacific and diversified across major industries including oil & gas, materials, industrials, consumer goods, health care, consumer services, telecommunications, utilities, financials & technology.

This means AutoWealth’s investment portfolios are generally more defensive against market turmoil and recessions than an investment portfolio that is concentrated in a particular asset class (eg. stocks) or geographical region (eg. Euro-Area) or industry (eg. technology).

AutoWealth achieves the strong diversification effect cost-efficiently through index-tracking Exchange-Traded Funds (ETFs) listed on the New York Stock Exchange and NASDAQ.

https://www.autowealth.sg/faq.php

There are four portfolios to chose from at different risk levels:

- Preservation: Bonds 80%, Share 20%

- Conservative: Bonds 60%, Share 40%

- Balanced: Bonds 40%, Share 60%

- Long-term Growth: Bonds 20%, Share 80%

What are the fees?

This seems to be the biggest selling point for AutoWealth. The management fees are lower than most of the other Robo Advisor’s and there is still a fairly low minimum investment amount of S$3,000 required to open an account.

MMG Verdict

The low fees, medium minimum investment account and personal custodian account are all great features of the AutoWealth platform. The sign up process and user experience seems cumbersome, especially verses the fintech platforms like Stashaway and could benefit from improvement.

Syfe

Syfe is a great option for beginner investors. It’s website is slick and reassuringly professional. The fees are in line with other Robo Advisors in Singapore and, as a bonus for beginner investors, there is no minimum investment amount required or lock up-period.

Syfe offers three portfolio types:

- Syfe’s Global Automated Risk-Management Investments: Syfe state that this portfolio allows you to invest in a blend of equity, bonds and gold Exchange Traded Funds (ETFs). There are 11 risk options available, no minimum lock-in periods, and is diversified across countries, sectors and assets.

- Syfe’s REIT+ portfolio: this portfolio mimics the iEdge S-REIT 20 Index, tracking blue chip Singapore REITs with a focus on real estate. Its a fairly low risk option and delivered a dividend yield of 5.1% for 2019. Syfe allow you to have dividends paid out quarterly to your bank account or reinvested automatically which is a nice feature. It is possible to shield your portfolio with Syfe’s Automated Risk-managed Investments (ARI) strategy. The ARI automatically adjusts your portfolio to ensure enhanced risk-adjusted returns by managing downside risk.

- Syfe’s Equity100 portfolio: as you might guess, this portfolio is designed to give maximum exposure to equities. At the time of writing, Syfe state on its website that this portfolio has generated 14% annual returns over the past 10 years. Syfe state that “The Equity100 portfolio combines global diversification with a smart beta approach. Using a multi-factor methodology, we select ETFs that are likely to have the highest expected risk-adjusted returns to a build a well diversified equity portfolio.”

What are the fees?

Fees depend on your customer categorisation. There are three tiers:

- Blue: no minimum investment, 0.65% fees and access to an investment advisor during your first month;

- Black: minimum S$20k investment, 0.5% and access to investment advisors but not on a dedicated basis;

- Gold: minimum S$100k investment, 0.4% fees, and access to a dedicated advisor to help with investment decisions.

MMG Verdict

Syfe is a great platform for beginner investors. The sign up process is easy, with a good user interface and low barriers to entry. Having access to the wealth advisors is a great additional perk over some of the other Robo Advisor platforms and might be particularly useful for beginners.

MoneyOwl

Money Owl doesn’t quite meet the criteria to be considered a Robo Advisor (though its very similar!). Money Owl offers an investment platform, however a human advisor is available to help you set up your portfolio. This is unlike the other Robo Advisor platforms whereby you usually just have to set your risk level, investment amount and portfolios and sit back. Practically speaking, the human element is the only discernible difference that Money Owl has to a true Robo Advisor, and it’s a nice additional perk to have.

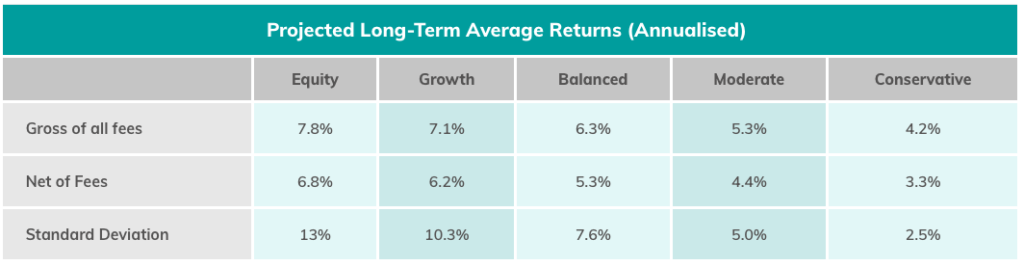

Money Owl offers 5 portfolios to choose from, each a mix of equities and bonds, with the equity mix split between developed and emerging markets as follows:

- Equity: 100% equity (88% developed / 12% emerging)

- Growth: 80% equity (70% developed / 10% emerging), 20% bonds

- Balanced: 60% equity (53% developed / 7% emerging), 40% bonds

- Moderate: 40% equity (35% developed / 5% emerging), 60% bonds

- Conservative: 20% equity (18% developed / 2% emerging), 80% bonds

Money Owl publish their anticipated rates of return for their portfolios (and they are not particularly impressive):

What are the fees?

A nice bonus is that until the end of 2021, Money Owl won’t charge any fees on the first S$10k invested with them. After that they charge 0.6% for the first S$100k invested and then 0.5% for amounts above S$100k.

MMG Verdict

If you want a true Robo Advisor, Money Owl is probably not it. Verses Stashaway and other platforms which have killer mobile apps, the user interface feels a little clunky and outdated.

The fee free promotional rate is a nice bonus and is particularly attractive to newbies. The low projected rates of return however put me off this platform.

Kristal.AI

Kristal.Ai has some of the lowest fees of all of the Robo Advisors and is definitely worth consideration when reviewing your investment options. I found their website a little confusing and is a little difficult to understand.

The main distinction is whether you are a retail investor (most people are) or a private wealth investor (those high net worth individuals who meet the definition of an ‘Accredited Investor’). From there you can set up an account, set your risk profile and decide which ‘Kristals’ (aka investment strategies) to invest in:

Kristal.AI is your digital wealth manager; which helps you meet your life goals and financial well-being in a cost-efficient and hassle-free manner.

We believe, what sets us apart is the optimal balance between the 150+ years of total experience in advisory and investment of the Kristal Investment Committee and our proprietary Artificial Intelligence-powered Advisory algorithm.

We bring to you more than 200 carefully created and managed investment strategies (Kristals) comprising stocks, bonds, exchange-traded funds from around the globe to choose from.

You can Get Advice from our proprietary online investment advisor within minutes to create a personalised investment portfolio, designed specifically to meet your investment requirements and investor profile.

We enjoy the support and the confidence from 10,000+ users from over 22 countries in managing more than USD 120 million as of Jan 2020.

https://kristal.ai/faqs/#1835

What are the fees?

This is the best bit. For investments up to S$50k, Kristal.Ai will not charge any fees (remember though you will still be pay fees from the underlying funds). There is also a super low minimum investment amount making the platform rally attractive.

MMG Verdict

Have a look around the website, perhaps sign up for an account and do some more research. As mentioned above the website is a little confusing and doesn’t contain as much information as on other platform’s websites.

Phillip Smart Portfolio

The Phillip SMART Portfolio is operated by Poems, a stalwart in the Singapore investment space. Their website is not however very informative and it looks like this is a bit of a work in progress than a fully built out platform like the other Robo Advisors. Its seems to be playing catch-up.

When you sign up you are first asked a series of 12 questions about risk tolerance and then are guided to a risk profile. The website doesn’t give a lot of information about what the risk profiles are or what goes into them. Though you may find out more if you dig deeper.

What are the fees?

The SMART fee is competitive though there is a minimum deposit amount of S$5,000 which might deter newbies. There are no fees for top-ups and withdrawals, and no upfront fees, brokerage fees or platform fees.

MMG Verdict

This platform might be one to watch for the future but currently doesn’t seem to compete well against StashAway, Endowus and Syfe in particular.

Traditional Bank Platforms

OCBC RoboInvest

RoboInvest is OCBC’s Robo Advisor platform. The big Singapore banks are all developing their own platforms t compete with the FinTech platforms above, and OCBC is no different.

The initial investment amount is only S$100 and there are 33 portfolios to choose from (compare that to a S$1,000 minimum for DBS and only 2 portfolios). The portfolios are really diverse – including the recently added ‘US Cloud Computing’ and ‘Gen Z Winners’ portfolios. A full list is available here and all of this flexibility is a plus! Being backed by a big bank is always reassuring from a financial prudence perspective.

One thing to bear in mind is that RoboInvest is only open to customers holding an OCBC current or savings account, and who have set up online banking.

What are the fees?

The RoboInvest fees are high, higher than the other banks and much higher than the FinTech based platforms.

MMG Verdict

The main advantage of RoboInvest are the 33 thematic portfolio choices, the (huge) downside is the high management fee. This, along with the underlying fun fees, will really eat away at growth over the medium to long term. Fees aside, the platform is user friendly and backed by a big Singapore bank which is always reassuring.

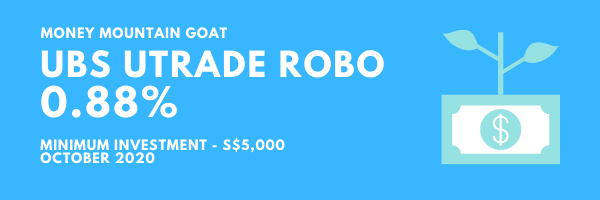

UOB Utrade Robo

https://www.utraderobo.com/robo/about

UOB UtradeRobo seems to severely trail both OCBC and DBS. The website contains little information, is clunky and not very user intuitive. Fees are high (though similar to OCBC).

What are the fees?

MMG Verdict

If you already bank with UOB, this might be an interesting option to explore future – though likely only for convenience alone. The bad user interface and high fees are a turn off for me.

DBS DigiPortfolio

https://www.dbs.com.sg/personal/investments/other-investments/dbs-digiportfolio

The DBS DigiPortfolio is styled as a hybrid robo-advisor. Their algorithm does most of the work but DBS believe that there is added value by still retaining the human touch.

The DigiPortfolio comes in two flavours:

- Asia Portfolio: this portfolio focuses on Asia and invests in Singapore listed ETFs focused on Singapore, India and China. The minimum investment is S$1,000; and

- Global Portfolio: this portfolio has a global focus and invests in UK listed ETFs with a global exposure.

Within each portfolio you are able to chose your risk level from the following:

- Slow & Steady (Risk Level 2): 17% equities (shares), 78% fixed income (bonds), 5% cash;

- Comfy Cruisin (Risk Level 3): 52% equities, 42% fixed income and 5% cash; and

- Fast & Furious (Risk Level 4): 77% equities, 18% fixed income and 5% cash.

Even from the language used that DBS are trying to appeal to a broad market base, especially those unfamiliar with investing in the stock and bond markets.

Rebalancing quarterly and automatically. Dividends are automatically reinvested. You will need to be an existing DBS customer.

What are the fees?

High interest savings account alternative?

Unlike with some of the challenger platforms, there is no high interest savings account alternative. Given the three tiers of risk profile and lack of restrictions on withdrawals etc., this is likely because you could open a new DigiPortfolio with a low risk profile to seek the same return as StashAway Simple.

MMG Verdict

I personally like the DigiPortfolio. As I hold my current account with DBS, its useful to see my DigiPortfolio balance when I log in. It’s easy to open and to track and the fees are manageable. As mentioned above, I use DigiPortfolio as the home for my emergency fund, for me, I’m comfortable with the risk level and I can withdraw my money anytime and quickly (roughly 3 business days). The high fees however will eat away at your returns over the medium-long term.

On the down side however, DBS has not developed a clean user friendly app, everything is done through the usual DigiBank dashboard. Previously, you couldn’t obtain much information from the mobile app, though this has recently changed (Oct 2020) to now at least show the current rate of return and S$ value increase/decrease. The other issue is that DBS hold a large amount of your investment in cash (5%), on which you pay their 0.75% management fee. They do this as their fees come out of this cash portion, but equally you are essentially paying DBS to hold your cash for you which is expensive! Finally, you can’t currently invest funds held in your SRS account, though DBS seem to be working on adding this functionality.

A thorn in your side – the LARGE Annual Fees for Singapore Robo Advisors

We’ve summarised all the headline fees charged below for easy comparison. Check the platform’s website for their current fees as they frequently change:

Generally speaking, the fees are less of an issue for shorter term trading. But as soon as you keep your money in a Robo Advisor account for longer than 1 or 2 years, then you’d most likely be better off in investing directly yourself in a low cost index fund. You may or may not get better returns from a Robo Advisor but, it is likely that the returns would be just as good by a long term investment into a low cost index fund. Time and time again these have out performed actively managed portfolios – its probably too early to see how a Robo Advisor will perform in the longer term though, so watch this space!

Are Robo Advisors Suitable for people on the path to FIRE?

Everyone’s FIRE journey is different and its important to review the accounts available and do your own research. This post seeks to open your eyes to what is out there; but I make no recommendations on what you should do with your money. Only you can decide that!

For those who are new to investing, and indeed the FIRE path, Robo Investors may be a good way to dip your toe in whilst you do your research. For example, they could also be a good place to stash your emergency fund, depending on your risk appetite. I keep my emergency fund in the Fast and Furious DBS DigiPortfolio. They are generally intuitive, millennial friendly and pretty easy to understand. The key drawbacks are:

- sometimes high minimum investment amounts, especially to unlock lower annual management fees; and

- the relatively high annual management fees vs direct index fund investing, though they are of course much lower than traditional investment advisor fees.

Personally, I looked at using Stash Away and DBS as my preferred choices. I ended up going for DBS and only to store my emergency fund. I use my brokerage account with Saxo for my general index fund investing.

Are you already using any of the Robo Advisors above? Share your thoughts in the comments below.

If you want to follow along with my FIRE journey and never miss out on any post, please subscribe to the MMG newsletter:

Jon

16/11/2020 6:27 pmAmazing guide! I’m closely following all of your blogs.

Money Mountain Goat

17/11/2020 10:58 amThanks very much Jon. Glad you found it useful!

Abel

15/04/2021 11:51 pmWhich Digiportfolio (asia or global) did you use for your emergency funds?

Money Mountain Goat

16/04/2021 1:46 pmHey Abel! I went for the Asia portfolio and level 4 (fast and furious) risk level which i’m comfortable with as i’m still (fairly) young! : ) I’ve been pretty impressed with the whole experience with them though their 0.75% fee is still quite high (as a comparison the S&P index fund tracker VUSA:xlon charges 0.07% in management fees).